Datos de tendencia: Creciente demanda de transparencia en la cadena de suministro

A 2024 El informe McKinsey revela que 73% de los proveedores de automoción están adoptando activamente pasaportes de productos digitales basados en NFC (DPPS), impulsado por dos presiones críticas:

Reglamento de la UE (UE) 2025/…: Exige DPP para todos los componentes del vehículo antes de julio 2025, que requiere seguimiento en tiempo real de:

- Minerales en conflicto (P.EJ., cobalto de las minas de la RDC)

- Huella de carbono (verificado según ISO 14064)

- Proporciones de material reciclado (objetivo estadounidense: 25% plásticos reciclados por vehículo por 2030)

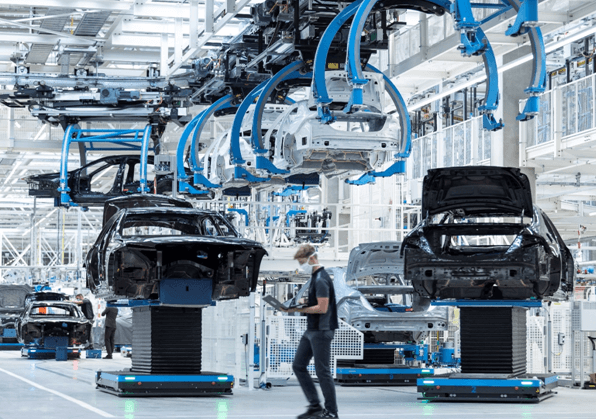

Requisitos de OEM: BMW, Mercedes-Benz, y Volvo ahora requiere Tier 1-3 Los proveedores proporcionarán DPP legibles por NFC para estar preparados para las auditorías..

Los informes manuales no logran escalar: Los proveedores que utilizan sistemas basados en papel se enfrentan 28% plazos de entrega más largos y costos de cumplimiento 5 veces mayores (Estudio automotriz de Deloitte, 2023).

Ventaja técnica: Ventajas únicas de NFC para la trazabilidad automotriz

Etiquetas NFC integrados en componentes resuelven desafíos automotrices críticos:

a.Trazabilidad a nivel de VIN

Cada etiqueta se vincula al VIN y a las tiendas de un vehículo.:

- Origen del componente: P.ej., Los sensores de freno de Bosch están etiquetados con datos de cobalto desde la mina hasta la fábrica (alineado con la Iniciativa de Minerales Responsables de RMI).

- Actualizaciones en tiempo real: Tesla usa NFC para rastrear el estado de la batería después de la venta, actualizar los DPP con tasas de degradación basadas en el kilometraje.

b.Durabilidad en condiciones adversas

RFIDHYNTAG 424 Las etiquetas resisten:

- Temperatura: -40°C a +150°C (crítico para las piezas del motor).

- Exposición química: Resistente al aceite de motor, liquido de frenos, y spray de sal.

c.NFC Antifalsificación

El cifrado AES-128 y los códigos TID únicos evitan piezas falsas. La empresa A redujo los incidentes de bolsas de aire falsificadas en 62% después de implementar DPP NFC en 2022.

[Video de demostración contra la cuenta de productos de lujo de YouTube]

Análisis de retorno de la inversión: Reducción de coste de 120 €/vehículo con NFC DPP

A 2023 Estudio de PwC que compara NFC vs.. DPP en papel muestra:

| Factor de costo | NFC DPP | En papel |

| Cumplimiento Laboral | 18€/vehículo | 85 €/vehículo |

| Impresión de etiquetas | 2 €/vehículo | 25 €/vehículo |

| Gestión de retiradas | 30€/vehículo | 120€/vehículo |

| Total | 50 €/vehículo | 230 €/vehículo |

Ahorro neto: 180€/vehículo – 73% de los proveedores alcanzan el punto de equilibrio dentro de 8 meses.

Estudio de caso: Micheli reduce el tiempo de recopilación de datos de proveedores secundarios en 65%

Desafío: Recopilación manual de datos de carbono de 200+ Los proveedores de caucho y acero retrasaron las presentaciones del SCIP..

Solución: Implementado Etiquetas NFC + Ficha verde SAP DPP plataforma.

Resultados:

- 65% agregación de datos más rápida (de 14 días para 5 días/mes).

- 100% Cumplimiento de la UE para más de 12 millones de neumáticos producidos anualmente.

- Ahorro anual de 2,1 millones de euros en costes de preparación de auditorías.

[Preguntar ahora: Pasaporte de producto digital automotriz]

(Envíe su correo electrónico para obtener acceso instantáneo.Investigado por 1,200+ Nivel 1 proveedores en el primer trimestre 2025.)