Δεδομένα τάσης: Αυξανόμενη ζήτηση για διαφάνεια εφοδιαστικής αλυσίδας

ΕΝΑ 2024 Η έκθεση McKinsey αποκαλύπτει ότι 73% προμηθευτών αυτοκινήτων υιοθετούν ενεργά ψηφιακά διαβατήρια προϊόντων που βασίζονται σε NFC (DPPS), οδηγείται από δύο κρίσιμες πιέσεις:

Κανονισμός ΕΕ (ΕΕ) 2025/…: Ενισχύει τα DPP για όλα τα εξαρτήματα του οχήματος έως τον Ιούλιο 2025, που απαιτεί παρακολούθηση σε πραγματικό χρόνο:

- Ορυκτά σύγκρουσης (Π.χ., κοβάλτιο από ορυχεία ΛΔΚ)

- Αποτύπωμα άνθρακα (επαληθεύεται κατά ISO 14064)

- Αναλογίες ανακυκλωμένων υλικών (στόχος των ΗΠΑ: 25% ανακυκλωμένα πλαστικά ανά όχημα από 2030)

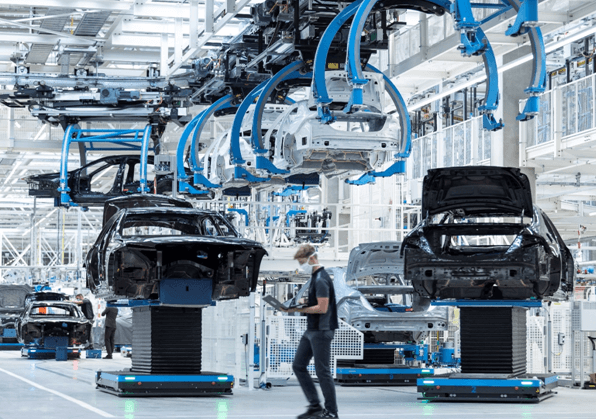

Απαιτήσεις OEM: BMW, Mercedes-Benz, και η Volvo απαιτούν πλέον Tier 1-3 προμηθευτές να παρέχουν DPP αναγνώσιμες από NFC για ετοιμότητα ελέγχου.

Η μη αυτόματη αναφορά αποτυγχάνει να κλιμακωθεί: Οι προμηθευτές που χρησιμοποιούν συστήματα που βασίζονται σε χαρτί αντιμετωπίζουν 28% μεγαλύτερος χρόνος παράδοσης και 5 φορές υψηλότερο κόστος συμμόρφωσης (Deloitte Automotive Study, 2023).

Τεχνικό πλεονέκτημα: Τα μοναδικά πλεονεκτήματα του NFC για την ιχνηλασιμότητα του αυτοκινήτου

Ετικέτες NFC ενσωματωμένα σε εξαρτήματα επιλύουν κρίσιμες προκλήσεις του αυτοκινήτου:

α.Ιχνηλασιμότητα επιπέδου VIN

Κάθε ετικέτα συνδέεται με το VIN ενός οχήματος και τα καταστήματα:

- Προέλευση συστατικού: Π.χ., Οι αισθητήρες φρένων της Bosch φέρουν ετικέτα με δεδομένα κοβαλτίου από ορυχείο σε εργοστάσιο (ευθυγραμμισμένο με την Πρωτοβουλία Υπεύθυνων Ορυκτών της RMI).

- Ενημερώσεις σε πραγματικό χρόνο: Η Tesla χρησιμοποιεί NFC για να παρακολουθεί την υγεία της μπαταρίας μετά την πώληση, ενημέρωση των DPP με ρυθμούς υποβάθμισης βάσει χιλιομέτρων.

β.Ανθεκτικότητα σε δύσκολες συνθήκες

RFIDHYτου NTAG 424 ετικέτες αντέχουν:

- Θερμοκρασία: -40°C έως +150 °C (κρίσιμο για τα μέρη του κινητήρα).

- Χημική Έκθεση: Ανθεκτικό στο λάδι κινητήρα, υγρό φρένων, και σπρέι αλατιού.

c.NFC Anti-Counterfeiting

Η κρυπτογράφηση AES-128 και οι μοναδικοί κωδικοί TID αποτρέπουν τα πλαστά εξαρτήματα. Εταιρεία Α μείωσε τα περιστατικά πλαστών αερόσακων από 62% μετά την ανάπτυξη NFC DPP σε 2022.

[Βίντεο επίδειξης ειδών πολυτελείας YouTube κατά της απομίμησης]

ROI Analysis: 120 €/Μείωση κόστους οχήματος με NFC DPP

ΕΝΑ 2023 Μελέτη PwC που συγκρίνει το NFC έναντι του. εμφανίζει DPP που βασίζονται σε χαρτί:

| Συντελεστής Κόστους | NFC DPP | Βασισμένο σε χαρτί |

| Εργασία συμμόρφωσης | 18€/όχημα | 85€/όχημα |

| Εκτύπωση ετικετών | 2€/όχημα | 25€/όχημα |

| Διαχείριση ανάκλησης | 30€/όχημα | 120€/όχημα |

| Σύνολο | 50€/όχημα | 230€/όχημα |

Καθαρή αποταμίευση: 180€/όχημα – 73% των προµηθευτών πετυχαίνουν το breakeven εντός 8 μήνες.

Μελέτη περίπτωσης: Ο Micheli μειώνει τον χρόνο συλλογής δεδομένων δευτερεύοντος προμηθευτή κατά 65%

Πρόκληση: Μη αυτόματη συλλογή δεδομένων άνθρακα από 200+ Οι προμηθευτές καουτσούκ και χάλυβα καθυστέρησαν τις υποβολές SCIP.

Διάλυμα: Αναπτύχθηκε Ετικέτες NFC + SAP Green Token DPP πλατφόρμα.

Αποτελέσματα:

- 65% ταχύτερη συγκέντρωση δεδομένων (από 14 ημέρες για να 5 ημέρες/μήνα).

- 100% Συμμόρφωση της ΕΕ για 12 εκατομμύρια ελαστικά που παράγονται ετησίως.

- Ετήσια εξοικονόμηση 2,1 εκατομμυρίων ευρώ στο κόστος προετοιμασίας του ελέγχου.

[Ρωτήστε τώρα: Διαβατήριο Ψηφιακού Προϊόντος Αυτοκινήτου]

(Υποβάλετε το email σας για άμεση πρόσβαση—ρώτησε με 1,200+ Κερκίδα 1 προμηθευτές στο 1ο τρίμηνο 2025.)