Dati di tendenza: Surging Demand for Supply Chain Transparency

UN 2024 Lo rivela il rapporto McKinsey 73% of automotive suppliers are actively adopting NFC-based Digital Product Passports (Dpps), driven by two critical pressures:

Regolamento UE (Unione Europea) 2025/…: Mandates DPPs for all vehicle components by July 2025, requiring real-time tracking of:

- Conflict minerals (PER ESEMPIO., cobalt from DRC mines)

- Impronta di carbonio (verified per ISO 14064)

- Recycled material ratios (EU target: 25% recycled plastics per vehicle by 2030)

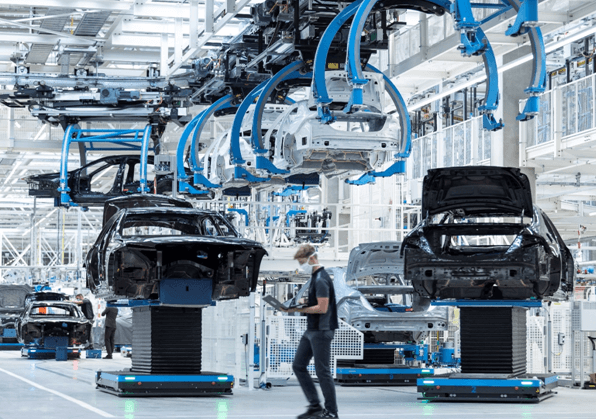

OEM Requirements: BMW, Mercedes-Benz, and Volvo now require Tier 1-3 suppliers to provide NFC-readable DPPs for audit readiness.

Manual reporting fails to scale: Suppliers using paper-based systems face 28% longer lead times and 5x higher compliance costs (Deloitte Automotive Study, 2023).

Vantaggio tecnico: NFC’s Unique Advantages for Automotive Traceability

Tag NFC embedded in components solve critical automotive challenges:

a.VIN-Level Traceability

Each tag links to a vehicle’s VIN and stores:

- Component Origin: E.g., Bosch’s brake sensors tagged with mine-to-factory cobalt data (aligned with RMI’s Responsible Minerals Initiative).

- Real-Time Updates: Tesla uses NFC to track battery health post-sale, updating DPPs with mileage-driven degradation rates.

b.Durability in Harsh Conditions

Rfidhy’s NTAG 424 tags withstand:

- Temperatura: -40°C to +150°C (critical for engine parts).

- Esposizione chimica: Resistant to motor oil, brake fluid, and salt spray.

c.NFC Anti-Counterfeiting

AES-128 encryption and unique TID codes prevent fake parts. Company A reduced counterfeit airbag incidents by 62% after deploying NFC DPPs in 2022.

[Video dimostrativo anticontraffazione di beni di lusso di YouTube]

Analisi del ROI: €120/Vehicle Cost Reduction with NFC DPP

UN 2023 PwC study comparing NFC vs. paper-based DPPs shows:

| Fattore di costo | NFC Dpp | Paper-Based |

| Compliance Labor | €18/vehicle | €85/vehicle |

| Label Printing | €2/vehicle | €25/vehicle |

| Recall Management | €30/vehicle | €120/vehicle |

| Total | €50/vehicle | €230/vehicle |

Net savings: €180/vehicle - 73% of suppliers achieve breakeven within 8 mesi.

Caso di studio: Micheli Cuts Secondary Supplier Data Collection Time by 65%

Sfida: Manual collection of carbon data from 200+ rubber and steel suppliers delayed SCIP submissions.

Soluzione: Distribuito Tag NFC + SAP Green Token Dpp piattaforma.

Risultati:

- 65% faster data aggregation (da 14 giorni a 5 days/month).

- 100% EU compliance for 12M+ tires produced annually.

- €2.1M annual savings in audit prep costs.

[Informati ora: Automotive Digital Product Passport]

(Submit your email for instant access—Enquired di 1,200+ Livello 1 suppliers in Q1 2025.)