Trenddata: Stigende efterspørgsel efter forsyningskædegennemsigtighed

EN 2024 Det afslører McKinsey-rapporten 73% af billeverandører anvender aktivt NFC-baserede digitale produktpas (DPP'er), drevet af to kritiske tryk:

EU-forordning (EU) 2025/…: Mandater DPP'er for alle køretøjskomponenter inden juli 2025, kræver realtidssporing af:

- Konfliktmineraler (F.eks., kobolt fra DRC miner)

- Carbon fodaftryk (verificeret efter ISO 14064)

- Genbrugsmaterialeforhold (amerikansk mål: 25% genbrugsplast pr. køretøj pr 2030)

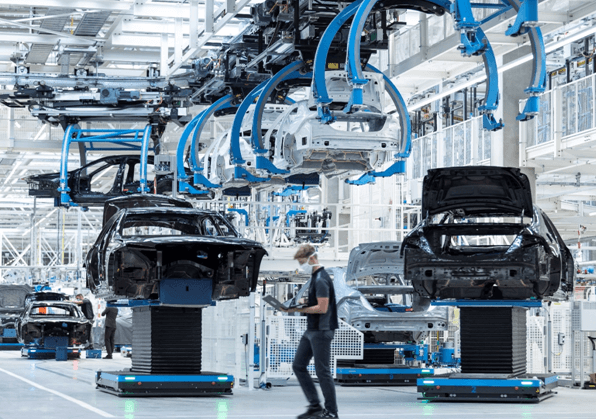

OEM-krav: BMW, Mercedes-Benz, og Volvo kræver nu Tier 1-3 leverandører til at levere NFC-læsbare DPP'er til revisionsberedskab.

Manuel rapportering kan ikke skaleres: Leverandører, der bruger papirbaserede systemer står over for 28% længere leveringstider og 5x højere overholdelsesomkostninger (Deloitte Automotive Undersøgelse, 2023).

Teknisk kant: NFCs unikke fordele for sporbarhed i biler

NFC -tags indlejret i komponenter løser kritiske biludfordringer:

a. Sporbarhed på VIN-niveau

Hvert tag linker til et køretøjs VIN og butikker:

- Komponent oprindelse: F.eks., Boschs bremsesensorer mærket med mine-til-fabrik-koboltdata (på linje med RMI's Responsible Minerals Initiative).

- Realtidsopdateringer: Tesla bruger NFC til at spore batteriets tilstand efter salg, opdatering af DPP'er med kilometer-drevne nedbrydningsrater.

b. Holdbarhed under barske forhold

RFIDHY's NTAG 424 tags tåler:

- Temperatur: -40°C til +150 °C (kritisk for motordele).

- Kemisk eksponering: Modstandsdygtig over for motorolie, bremsevæske, og saltspray.

c.NFC Anti-Forfalskning

AES-128-kryptering og unikke TID-koder forhindrer falske dele. Company A reducerede forfalskede airbaghændelser med 62% efter at have installeret NFC DPP'er i 2022.

[YouTube-demonstrationsvideo for luksusvarer mod varemærkeforfalskning]

ROI analyse: 120 €/reduktion af køretøjsomkostninger med NFC DPP

EN 2023 PwC-studie, der sammenligner NFC vs. papirbaserede DPP'er viser:

| Omkostningsfaktor | NFC DPP | Papirbaseret |

| Overholdelse Labor | 18 €/køretøj | 85 €/køretøj |

| Etiketudskrivning | 2 €/køretøj | 25 €/køretøj |

| Tilbagekaldelsesledelse | 30 €/køretøj | 120 €/køretøj |

| Total | 50 €/køretøj | 230 €/køretøj |

Nettobesparelse: 180 €/køretøj – 73% af leverandører opnår breakeven indenfor 8 måneder.

Casestudie: Micheli skærer sekundær leverandørdataindsamlingstid af 65%

Udfordring: Manuel indsamling af kulstofdata fra 200+ gummi- og stålleverandører forsinkede SCIP-indsendelser.

Løsning: Indsat NFC -tags + SAP Green Token DPP platform.

Resultater:

- 65% hurtigere dataaggregering (fra 14 dage til 5 dage/måned).

- 100% EU-overholdelse for 12M+ dæk produceret årligt.

- 2,1 mio. € årlige besparelser i omkostninger til forberedelse af revision.

[Spørg nu: Digitalt produktpas til biler]

(Indsend din e-mail for øjeblikkelig adgang—spurgte ved 1,200+ Tier 1 leverandører i 1. kvartal 2025.)